HONEST MONEY TALKS:

FINANCIAL LITERACY LIBRARY

Our library of our Honest Money Talks blog is here for you to sharpen your financial literacy skills even further. Indulge in some self-directed learning by selecting one of the topic categories and continue to grow your knowledge with our expertly written, plain language blogs.

5 Ways to Use Your Mortgage Cash Back Wisely

A cash back mortgage can be more than just a bonus — it can be a boost toward real financial progress. Whether you’re getting $1,000 or $5,000, that money can go a long way when used intentionally. Here are five smart ways to make the most of your mortgage cash back.

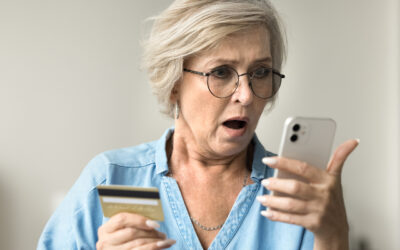

LOOKING OUT FOR YOU: STAYING SAFE FROM ELDER FRAUD

At YNCU, we care about more than just your money—we care about you. Sadly, fraud targeting older adults is becoming more common, and we want to make sure you and your loved ones stay safe.

Financial Spring Cleaning: Reviewing Your Budget and Setting New Goals for the Next Quarter

As the days get longer and the flowers start to bloom, spring is the perfect time to refresh more than just your home—it’s also an ideal moment to tidy up your finances. A financial spring cleaning can help you reassess your budget, track your progress, and set new financial goals for the next quarter.

How to Protect Yourself from Phone Scams: Verifying Calls from Your Credit Union

Have you ever received a call from someone claiming to be from your credit union? In today’s world, it’s important to know how to verify these calls to keep your personal and financial information safe. Fraudsters often pretend to be financial institutions to steal sensitive details, so staying informed is your best defense.

Best Practices for Filing Your Taxes in Canada

Filing taxes can be a daunting task, but with the right approach, it can be a smooth process. Here are some best practices to consider when filing your taxes in Canada.

Power of Attorney vs. Joint Accounts: What You Need to Know

Managing money isn’t just about budgeting and paying bills—it’s also about making sure the right people have access when you need them to.

Mistakes You Can Make with an RRSP & How to Avoid Them

When it comes to RRSPs (Registered Retirement Savings Plans), there are a few common mistakes that can negatively impact your savings or tax strategy. Here are some of the most common mistakes and tips on how to steer clear of them.

Beware of the debit card theft scheme

A troubling new theft scheme is making the rounds. Criminals are watching unsuspecting victims as they enter their PINs at ATMs or while making in-store purchases. Once the thief has seen the PIN, they execute a plan to deceive you to allow them access to the card in some way.

the crucial role of regularly updating information

In the fast-paced world of modern finance, where technological advancements and changing circumstances are constant, maintaining up-to-date information with your credit union is not just a formality but a crucial part of responsible financial management.

Reminders For Your 2025 Finance Journey

Reminders For Your 2025 Finance Journey January 6th, 2025 The new year offers the perfect...

The Social Media Effect: A New Christmas Shopping Saga

The holiday season has always been synonymous with the spirit of giving, but as we scroll through our social feeds, it seems the way we spend during Christmas has taken on a new form. Social media, an ever-present force in our lives, has subtly shifted our holiday shopping habits, and it’s worth unwrapping this phenomenon to understand how.

Keeping Your Finances Safe this Festive Season

As the hustle and bustle of the holiday season arrives, many of our members will experience a short-term change in their spending habits. Many of us are spending more at places where we may not usually shop, and we may not be as diligent with our finances as we are the rest of the year due to the business of the season.

The Importance of Financial Literacy for Youth

Imagine a world where every teenager can confidently navigate the financial seas, steering clear of debt icebergs and sailing towards a horizon of economic stability. This isn’t just a fanciful dream; it’s the potential reality we can foster through teaching our youth about financial literacy.

How to Respond or React to Potential Scam Alerts

Before responding to a potential scam, it’s crucial to consider several factors to protect yourself from falling victim to fraudulent schemes.

Spooky Situations to Avoid in Your Financial Journey

Embarking on your financial journey can feel like setting sail in uncharted waters. With a myriad of options and paths, it’s easy to feel overwhelmed or make missteps that could lead to choppy seas ahead. But fear not! By being aware of common pitfalls, you can navigate these waters with confidence and reach your fiscal destinations unscathed.

How to Spot a Fraudulent Cheque: Key Signs and Risks

Fraudulent cheques can cause significant financial loss and legal trouble. With the rise of mobile banking, cheque fraud schemes have evolved, and it’s important to know how to identify a fake cheque.

STEPS TO CREATING A POSITIVE MONEY MINDSET

Creating a positive money mindset involves a combination of self-reflection, education, and habit-building. A positive money mindset not only enhances your financial situation but also contributes to your overall quality of life. It empowers you to take control, make informed decisions, and approach financial challenges with confidence.

HOW TO MAKE A STRONG PASSWORD

Creating a strong password is crucial for protecting your online accounts from unauthorized access. If your online accounts get hacked, the consequences can be severe and far-reaching.

A Student’s Guide to Financial Aid

Navigating financial aid in Canada involves understanding a range of options, including federal and provincial programs, scholarships, and loans. Here’s a comprehensive guide to help you through the process:

Beware of Phishing: How to Detect & Respond to Suspicious Emails

In today’s digital age, phishing has become a prevalent threat to online security. Phishing attacks involve fraudulent attempts to obtain sensitive information, such as usernames, passwords, and credit card details, by masquerading as a trustworthy entity in electronic communities.

Financial Planning as a New Canadian

Welcome to the land of opportunities! As you embark on this exciting chapter, getting a firm grip on your finances is as crucial as unpacking your suitcases. Organizing your finances is not just about keeping your dollars and cents in check; it’s about setting the stage for a life of security and possibilities in your new home.

Common Marketplace Scams: How to Stay Vigilant and Protect Yourself

Common Marketplace Scams: How to Stay Vigilant and Protect Yourself July 4, 2024 In today's...

Everything You Need to Know About Debt Consolidation

Debt can be a slippery slope, and before you know it, you’re staring at a mountain of bills with various interest rates and due dates. If this sounds familiar, debt consolidation might just be the lifeline you need to regain your financial footing.

What’s Trending in the Fraud Scene?

In an age where convenience is king, mobile banking has become a staple for many. With just a few taps on your smartphone, you can deposit cheques, transfer funds, and manage your finances on the go. However, amidst this convenience lies a lurking danger: the “For Mobile Deposit Only” cheque scam.

Embracing Neurodiversity: A Path to Financial Well-being

Neurodiversity recognizes the natural variations in how our brains think, learn, and interact with the world. But what does this have to do with financial well-being? Plenty!

Navigating Domestic and International Wire Transfers: Requirements, Regulations & Essentials

In today’s interconnected global economy, the ability to swiftly transfer funds domestically and internationally is crucial for individuals and businesses alike. Whether it’s paying bills, purchasing goods and services, or facilitating transactions across borders, wire transfers have become a cornerstone of modern financial transactions.

Unveiling Sustainable Investing: A Path to a More Diverse Portfolio

Have you ever pondered the impact of your investment dollars? It’s not just about growing wealth; it’s also about nurturing the planet and its inhabitants. Enter sustainable investing, the savvy approach that intertwines ethical values with financial acumen.

THE DEEPENING DANGERS OF DEEPFAKE AI

In recent years, the rise of deepfake technology has sparked widespread concern and fascination.

What You Need to Know About Travel Scams

Scams targeting travelers and tourists are not uncommon. Being aware of common scams can help you avoid falling victim to them.

You’ve opened an RRSP! Now what?

Congratulations on taking a fantastic leap forward by opening a Registered Retirement Savings Plan (RRSP)! This trusty vessel is set to guide you toward the tranquil shores of retirement, but it won’t sail itself. How do you ensure your journey is smooth sailing and not adrift in the open seas?

Steps to start the new year on the right foot – Finance Edition

It’s not just about setting goals; it’s about forging a path that weaves financial wisdom with actionable strategies.

Phishing and Smishing

Many phishing/smishing messages appear to be from a trustworthy and reliable source, like your bank or another business you know. Always be cautious, even if you think you recognize the business that the message is from.

2023 in Review: Finance Edition

As we approach the end of 2023, let’s discuss what happened this year in the Canadian world of finance, what happened with our personal money management, and how we can improve our financial situation in 2024.

Are you under A.T.T.A.C.K?

Social manipulation, in the context of fraud, is the art of manipulating end users into providing personal or confidential information. Personal cyber-attacks come in many forms.

SAVING SMART FOR ALL STAGES OF LIFE

Whether it’s graduating, buying a house, getting married, or retiring after years of a fulfilling career, we need a plan for every stage of life.

THE FOUR CORNERSTONES OF INTERNET SECURITY

While the internet offers incredible opportunities and convenience, it also comes with its fair share of security dangers. These four cornerstones of internet safety can help you keep your information secure online.

Ransomware: You’ve been hacked!!

Ransomware is software designed to deny or restrict access to your device or files until you pay. The general rule is don’t pay the ransom! There is no guarantee you will get access back, and paying increases the likelihood that you will be targeted again.

HOW TO IMPROVE YOUR CREDIT SCORE

Are you an adult living in Canada who wants to improve your credit score? You’re not alone! A good credit score is essential for financial stability and can open doors to opportunities like getting approved for loans or securing housing.

CRIME AND ABUSE AGAINST SENIORS

When it comes to financial crimes, seniors are targeted in almost every way, including aggressive telemarketing, fraudulent home repairs, health or investment schemes, technology schemes, romance or urgent family schemes, just to name a few.

PROTECT YOUR ACCOUNT WHEN BANKING ONLINE

No one is invincible. Awareness and diligence are key factors needed to minimize risk your risk of fraud when banking online.

THE FINANCIAL LITERACY GAP WITH INDIGENOUS COMMUNITIES

Financial literacy (understanding concepts such as budgeting, saving, investing, and understanding credit) is an essential skill that empowers individuals to make informed and responsible financial decisions.

PROTECTING YOURSELF WHEN THERE ARE NO RED FLAGS

Privacy breaches can be a nightmare to deal with and have rippling effects across a person’s life. They are becoming more frequent as technology improves and knowledge spreads.

SPOTTING THE RED FLAGS OF AN ONLINE SCAM

Scammers are becoming smarter, refining their methods and strategies daily to trick people. After working in the same ‘industry’ for so many years, they have discovered some strong swindles few people can detect.

Bank of Canada Rate Hikes Explained

In July of 2023, The Bank of Canada increased its target for the overnight rate to 5%, with the Bank Rate at 5¼% and the deposit rate at 5%.

ON THE WAY TO WEALTH WITH ASSETS

Interested in building wealth? Curious about investments and assets? You’ve come to the right place. If you’re looking to secure your financial future, building a solid portfolio is a crucial step in achieving your goals.

HOW TO PRACTICE GOOD PC HYGIENE

Maintaining good PC hygiene is like building a fortress around your digital world. Here are 10 steps to follow to help keep your sensitive information safe.

THE EVOLUTION OF FRAUD

In an era where technology is advancing at unprecedented speeds, the dark underbelly of fraud is not far behind, constantly morphing into more intricate forms.

POWER OF ATTORNEY (POA) VS JOINT ACCOUNTS

Safely managing finances as you age can be pretty stressful, so let’s break down some options to help better prepare you if the time comes.

STARTING A SMALL BUSINESSThe Dos and Don’ts

YNCU is dedicated to supporting small businesses in our communities and we want to see you succeed in making your lifelong dreams a reality.

INVESTING IN A GIC

Invest with no risk! A Guaranteed Investment Certificate (GIC) is a great option for every type of investor. Available in short and long terms, your original investment is 100% protected from the fluctuations of the market – so you have nothing to lose and everything to gain.

MARCH IS FRAUD PREVENTION MONTH IN CANADA

First and foremost, be wary. Don’t be afraid to hang up the phone, ignore an email or close your internet connection – and please, never be fooled by the offer of a valuable prize in return for a low-cost purchase.

WHY YOU NEED TO START AN RRSP TODAY

Retirement is something we should all be thinking about, regardless of your age or where you are in life. A Registered Retirement Savings Plan (RRSP) is a government approved plan created to help you financially prepare for retirement.

HOW TO TAKE CONTROL OF YOUR HOLIDAY SPENDING

Here are some tips on how to keep control of your finances this holiday season so you aren’t starting the new year with a financial disaster on your hands.

THINGS TO KNOW BEFORE LIVING ON YOUR OWN

Eager to live on your own? Have plans to move out of your parents’ place? At YNCU we know how exciting it is to get your own place and start your own journey.

THINGS TO KNOW BEFORE ENTERING THE HOUSING MARKET

School does not prepare you for the financial risk you take when purchasing a home for the first time. We want to share with you some tips to help you enter the housing market, responsibly.

BE READY FOR THE UNEXPECTED

At YNCU, we understand how unpredictable life can be and we want to help set you up for financial success. Oftentimes, when planning finances, people only think of their savings, retirement, and managing their debt.

INFLATION AND BACK TO SCHOOL

At YNCU, we know back-to-school can cause a lot of stress during this time of inflation. Rising costs have caused people to have to limit their spending and focus on the essentials.

CYBERSECURITY – WAYS TO PROTECT YOURSELF

At YNCU, we know how important it is for you to feel safe with your finances. The threat of cyber-attacks has been on the rise and your finances can be vulnerable online.

DEBUNKING CONTROVERSIAL MONEY MYTHS

At YNCU, we know that you take your finances seriously. You want to protect your financial assets as best as you can. There are a lot of widely held ideas about money that are simply not true.

RATE HIKES/COST OF LIVING – SURVIVAL TIPS FOR MANAGING RAPID PRICE INCREASE AND DEFLATION

Prices have gone up in every aspect from groceries to the skyrocketing price of gas to interest rate hikes. This has caused a lot of alarm and concern for Canadians who are struggling to keep themselves financially stable.

WAYS TO FUND YOUR EDUCATION

At YNCU we know planning how to fund your education is stressful. Everyone’s situation is different, so if you’re looking for alternative ways to pay for school, other than family or government loans, here are some tips that may help.

MAKE YOUR SCHOLARSHIP APPLICATION STAND OUT

Ontarians pursuing post-secondary education can apply for funding from the Ontario Credit Union Foundation. The foundation supports students in academic, vocational, or technical programs at accredited institutions in Canada or abroad.

GUIDE TO PAYING OFF STUDENT LOANS

Graduating from college or university is a very exciting time as you start your careers and begin living independently. But, it can also be a very stressful time as the reality of student loan repayment sinks in.

HOW TO TEACH YOUR KIDS ABOUT MONEY

Providing your kids with a solid sense of financial literacy can help develop their skills and secure a stable financial future in adulthood.

HOW TO MANAGE YOUR MONEY WHILE IN SCHOOL

Going to college or university is an exciting new venture. For many young adults, this means living on their own for the first time, making new friends and maybe learning to balance school and a part-time job for the first time.

CONTROL YOUR FINANCES POST-GRAD

As a recent graduate, you likely have your first job and are making more money than before. This life transition also brings new major goals, such as getting your first car, finding a new apartment, taking the next step with a partner etc.

4 TIPS TO GET OUT OF DEBT

Thirty-eight percent of Canadians say money is the number one source of stress in their lives and debt is a debilitating financial topic over which people feel they have little control.

WOMEN ON A LEVEL PLAYING FIELD WITH MONEY

The gender pay gap in Canada has been an issue for decades. Women across various industries and professional levels have been experiencing economic inequality. According to Statistics Canada, women earn $0.87 for every dollar earned by men.

PROMOTE FINANCIAL EQUALITY

Rabo shares his expertise and helps us understand how to better address financial inequality, promote access to resources and improve financial literacy.

PLANNING TO PURCHASE YOUR FIRST CAR

Is buying your first car something on your vision board? This major purchase is something not to be rushed into. Proper planning, research and advice is needed – ahead of time.

EXPLORING RACIAL INEQUALITY & MONEY

Centuries of institutional and systemic racism have led to a significant disparity between the wealth of white individuals and those who identify as visible minorities.

HOW TO ACHIEVE YOUR FINANCIAL NEW YEAR’S RESOLUTION

Getting in shape, eating healthier, and breaking bad habits. They’re all popular new year’s resolutions. But this year, thanks to the ongoing COVID-19 pandemic, improving our financial health is climbing closer to the top of the list.

HOW TO BUILD A BETTER BUDGET

The start of the year has us all googling ways to improve our money management, determined to start the year out right. Budgeting may seem overwhelming for the uninitiated or restrictive to those who’ve tried before and failed.

HOW YOU CAN SAVE MONEY DURING THE HOLIDAYS

While spending money during the holidays should never be necessary, we understand that everyone wants to be able to balance their financial goals with their holiday spending.

PROTECTING YOURSELF FROM COMMON FINANCIAL SCAMS

Being a victim of financial fraud can be devastating and is on the rise. With fraudsters finding new ways to target vulnerable populations, via phone, email or cybersecurity attacks, we need to be more diligent than ever before when on the lookout for common financial scams.

EMPOWER YOUR FINANCIAL FUTURE WITH A CREDIT UNION

October 20th was Credit Union Day! To honour this day, we wanted to share with you some background on credit unions and how YNCU makes an impact on the lives of our members.

THE TOP FINANCIAL TOOLS OUR ADVISORS ARE THANKFUL FOR THIS YEAR

Managing your money, whether it be saving for a dream vacation, your first home or investing for the future, can seem daunting at first.

YNCUniversity is a financial literacy resource hub and not an accredited educational institution that issues degrees.

2025 Your Neighbourhood Credit Union Limited. All rights reserved.